Why Waiting for the “Perfect Rate” Might Not Be Worth It

*THIS IS AN OPINION ARTICLE, THAT SPECULATES ON FUTURE MARKETS. USE OR RELIANCE OF ANY OPINIONS CONTAINED ON THIS ARTICLE ARE AT YOUR OWN RISK.

Published May 6, 2025.

Written by Marty Rodriguez

Have you noticed mortgage rates lately? One day they dip, the next day they’re climbing again. It’s enough to make anyone feel a little unsure especially if you’re thinking about buying a home.

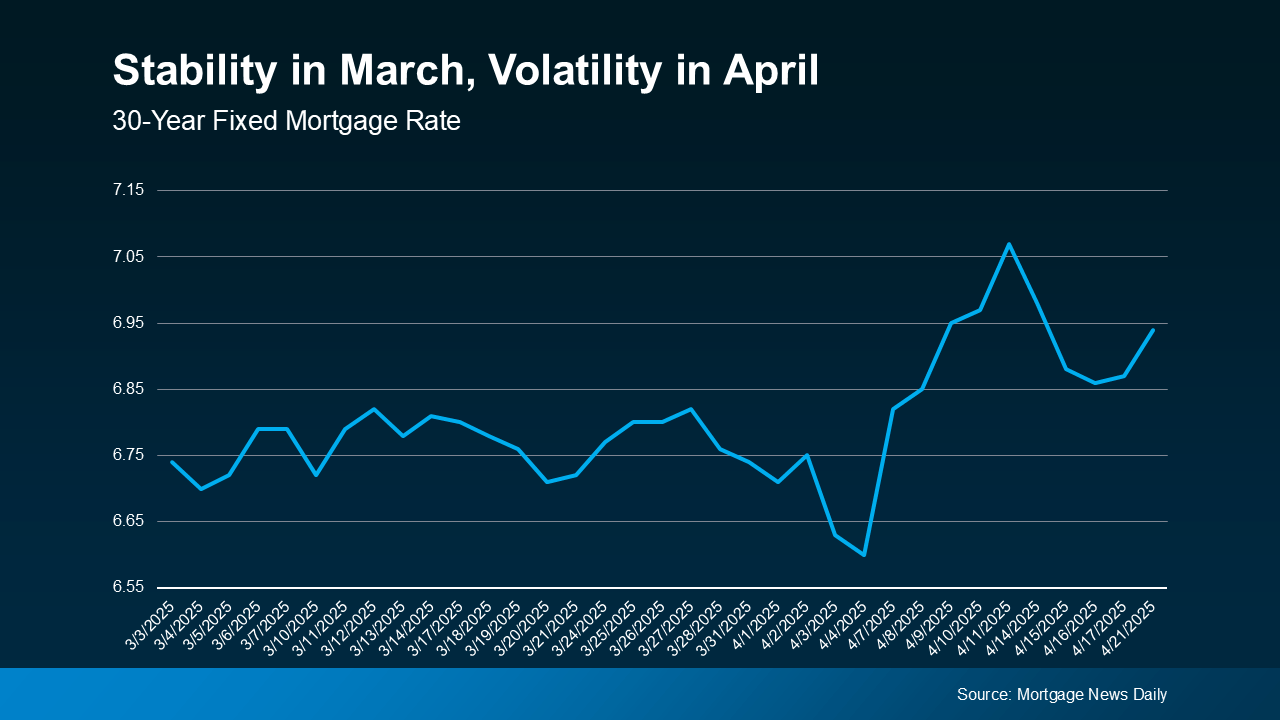

Check out this graph from Mortgage News Daily 👇

After a pretty steady March, April has been all over the place.

That kind of up-and-down movement is normal when there are big shifts in the economy. But here’s the thing: trying to “time the market” perfectly isn’t really the move.

Because while you can’t control mortgage rates, you do have power over a few key things that can seriously impact your rate.

Let’s break it down:

✅ Your Credit Score

A small boost in your credit score can make a big difference in the rate you qualify for and your monthly payment. Like Bankrate puts it:

“Your credit score is one of the most important factors lenders consider… The higher your score, the lower the interest rates and better terms you’ll qualify for.”

If you’re not sure where you stand or how to improve your score, now’s a great time to check in with a loan officer you trust.

✅ Your Loan Type

Not all loans are created equal. FHA, USDA, VA, and conventional loans each have different requirements and rate options. The Consumer Financial Protection Bureau puts it simply:

“Rates can be significantly different depending on what loan type you choose.”

That’s why it helps to talk to a mortgage pro and explore your options.

✅ Your Loan Term

You’ve probably heard of 15-, 20-, or 30-year loans. But did you know your term can affect not just your monthly payment, but your overall interest rate and how much interest you’ll pay in total?

“Your loan term will affect your interest rate, monthly payment, and the total amount of interest you will pay over the life of the loan.” —Freddie Mac

It’s one more area where a trusted lender can help guide you to the best fit.

Bottom line?

You can’t control what rates are doing day-to-day. But you can control the steps you take to set yourself up for the best deal possible.

If you’re thinking about buying this year or even just want to understand your options let’s connect. We’re happy to walk you through it and point you in the right direction.

👉 Want expert guidance on whether to rent or sell?

Text or Call (626) 727-9481 for your personalized side-by-side comparison