How Mortgage Rates Actually Affect Your Monthly Payment

Hint: It’s Not Just About the Number You See in the Headlines

*THIS IS AN OPINION ARTICLE, THAT SPECULATES ON FUTURE MARKETS. USE OR RELIANCE OF ANY OPINIONS CONTAINED ON THIS ARTICLE ARE AT YOUR OWN RISK.

Published July 25, 2025

Written by Marty Rodriguez

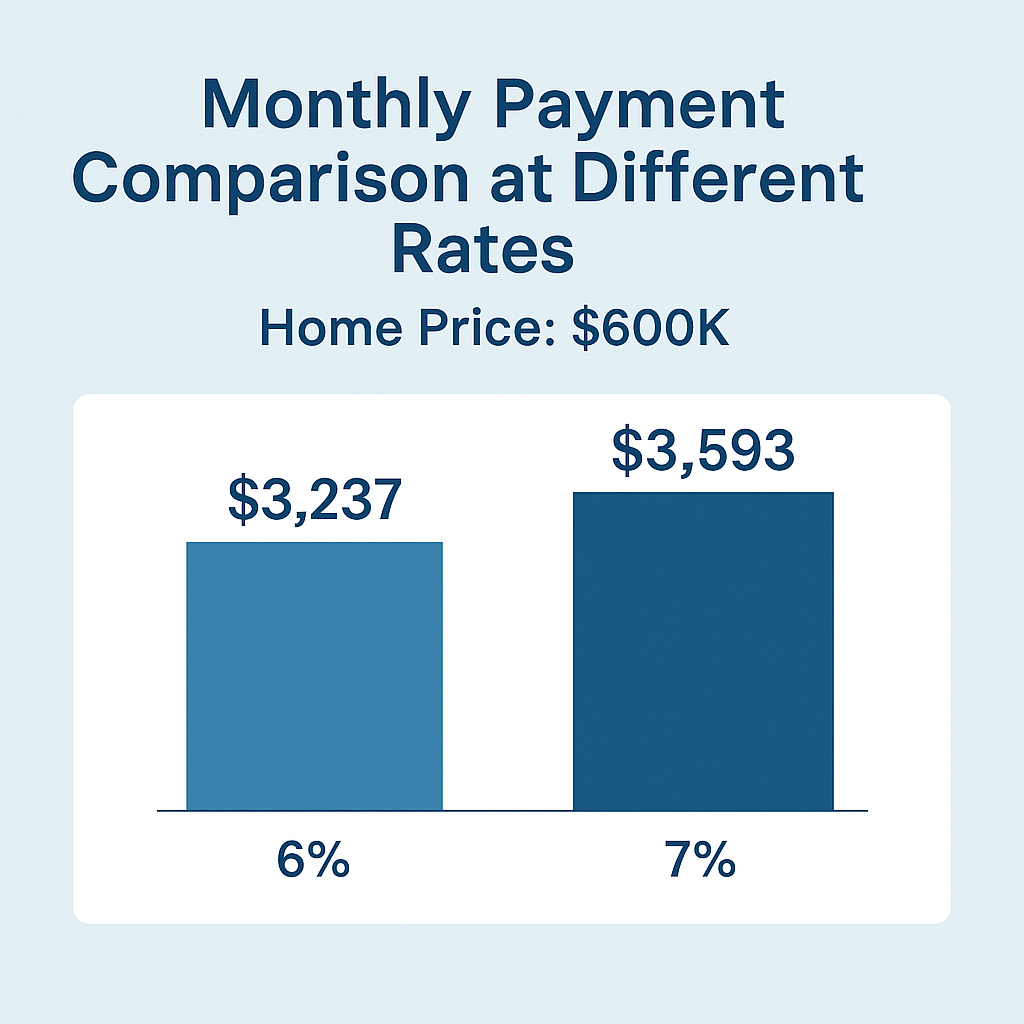

That’s a difference of $356/month.

It’s real money, but also not necessarily a deal-breaker.

What Smart Buyers Are Doing in 2025

Here’s how savvy buyers are making it work even with higher rates:

✅ Seller-Paid Rate Buydowns

Many sellers are offering credits to lower your interest rate for the first 1-3 years, helping you ease into payments.

✅ Temporary Rate Programs

Lenders are offering special products that let you lock a lower introductory rate and refinance later without paying all the fees again.

✅ Focusing on Monthly Comfort, Not Just the Rate

Your monthly budget is what matters most. And with proper planning, you can still secure a payment that works for you even in today’s market.

What Happens If You Wait?

There’s a common myth that waiting for rates to drop will solve everything. But while you're waiting…

Home prices may rise

Competition could increase

You might miss out on the right home for your needs

Even a slightly lower rate won’t always make up for a higher home price or lost opportunity.

Want to Know What Your Payment Would Actually Look Like?

We offer free, no-pressure payment breakdowns based on current rates and your specific goals. Whether you’re buying now or 6 months from now, this is the best way to get clear on your options.

👉 Contact us directly and we’ll run the numbers for you.

Final Thought

Don’t let interest rates be the reason you miss out on a home you love. With the right strategy, buying in today’s market can still make total financial sense. Let’s look at your options together, we’re here to help.

– The Marty Rodriguez Team

Your Trusted Local Real Estate Experts

📍 Glendora | Upland | Pasadena | Inland Empire

Bonus Tip:

Want to learn about how sellers are helping buyers with rate buydowns right now?

👉 Message us here to get the inside scoop.

👉 Want expert guidance on whether to rent or sell?

Text or Call (626) 727-9481 for your personalized side-by-side comparison

If you’re like many people right now, you’re keeping one eye on mortgage rates and the other on your dream home. But here’s the truth: a lot of what you’re hearing about interest rates isn’t the full story.

Most buyers hear “rates are high!” and assume they can’t afford to buy. But in reality, a 1% change in mortgage rates could mean $100–$300 more per month — and in many cases, that difference can be offset or planned for with the right strategy.

Let’s break it down.

What a 1% Interest Rate Increase Actually Costs You

Let’s say you’re looking at a $600,000 home and you’re putting 10% down. Here’s a simplified breakdown:

Client Story of the Week

“My wife and I are very thankful to Marty and her staff for a very efficient and smooth sale of Our property in Altadena. Marty is a a true professional in all ways that only years of experience and knowledge can produce. Having been in both Real Estate and Commercial Construction for many years myself that accolade does not come lightly from me. If you are thinking of listing or buying a property, Marty sets the ‘Gold Standard’.”

💬 Want to see more stories like this?

Check out our 300+ google reviews here. ⭐️⭐️⭐️⭐️⭐️

NAVIGATING THE

REAL ESTATE

MAZE:

ASK US ANYTHING!

Our team of real estate experts will answer a new question on our website and social media every. single. week.

Submit your questions, no matter how big or small to feel confident making informed decisions when it comes to all things real estate.

We’ve been serving the San Gabriel Valley & Los Angeles areas for over 46 years - if you can ask it, we can get the answer!